Increase in Property Tax Bill for Many in City

By Brandi Makuski

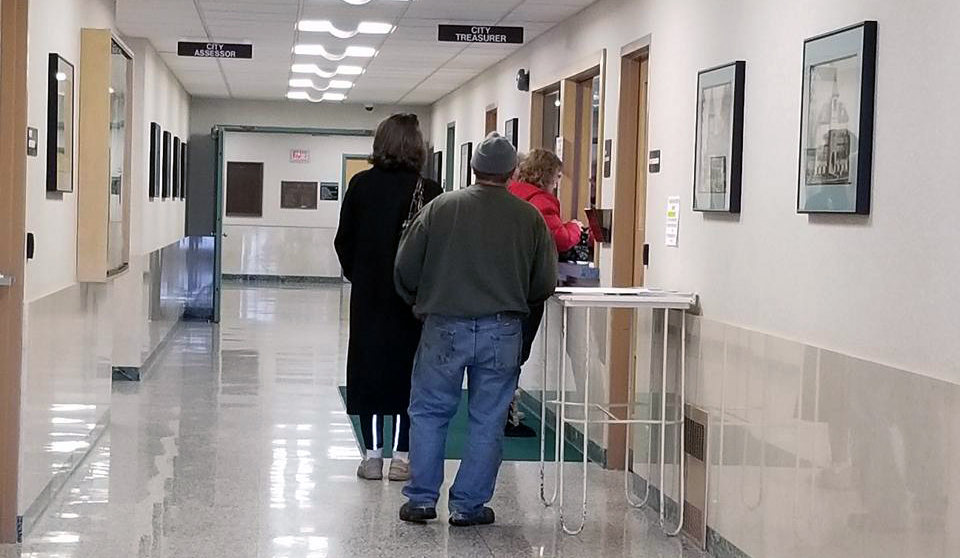

Some residents in Stevens Point received an unwelcome surprise when they opened this year’s tax bill.

Even though city property tax rates did come down from last year, some residents saw a large increase in their 2017 tax bill – an increase approved in October 2016 when the City Council voted in favor of almost $2 million in additional borrowing to pay for the city’s long-term capital maintenance plan.

According to City Treasurer Corey Ladick, property taxes decreased from $9.94 per thousand dollars of assessed value in 2016 to a rate of $9.56 this year. The mill rate this year is $22.22, he said, also down from the 2016 rate of $24.91.

The decreases, Ladick said, were thanks to a citywide revaluation, a lengthy process during which property values across Stevens Point were reassessed, meaning an increase to current market value for many property owners.

Ladick said the change has been confusing for many in the city.

“I’ve heard people say they don’t understand why their assessment went up, because they didn’t do anything to their house,” Ladick said. “What people need to remember is the assessment is supposed to represent the market value of your home. Just because someone didn’t do improvements, that doesn’t mean your home didn’t appreciate in value.”

The last revaluation took place in 2003, according to City Assessor Steve Shepro.

“I know a reval [sic] was planned for 2009, but due to the downturn of the market it didn’t make any sense at that time,” Shepro said last October, adding the reassessment followed Wisconsin Dept. of Revenue guidelines to ensure a home’s value and assessment actually match.

But a revaluation was only one factor behind the change in the 2017 tax bills; while tax rates may have decreased, the actual tax levy the city will collect for 2017-18 shot up by 12.45 percent – the biggest jump in several years.

By comparison, taxpayers funded a levy increase of 0.93 for 2015-16, and an increase of 2.99 percent for 2016-17.

“Some [residents] got hit pretty big this year.” Mayor Mike Wiza said of the most recent increase.

The long-term capital plan was approved late last year, after a months-long inventory process cataloging each piece of property the city had in its possession, Wiza said, which included “some 300-miles of lane roads, all the buildings, the trucks, everything.”

After taking into account the life expectancy and required maintenance for each of those items, he said, city officials were better able to determine their average capital expenses on an annual basis. While the tax levy collected for capital expenses is restricted to the city’s net new growth, the amount of levy applied for municipal borrowing has no such limitation, Wiza said.

“So this long-term capital plan has increased borrowing to almost another $2 million dollars,” he said. “This is a one-time adjustment in going up, but going forward, we shouldn’t need to increase borrowing.”

Wiza said residents will see improvements in road repairs and building conditions, and experience better-functioning equipment, such as garbage trucks, as a result of the new levy.

“We could have phased that [expense] in over a couple of years; the council chose not to do that; they chose to take the hit all at once,” Wiza said. “And the timing for that, I suppose, was less-than-cool, because the county also went up, the school district went up; the only thing that didn’t go up was, I think, the state [taxes].”

Ladick said his office has received more than a few phone calls from angry residents who said they were unaware the increase was coming, but the issue is now out of his hands.

“Those who didn’t agree [with their assessment] had their chance to appeal either directly with the city’s assessor, or during the Board of Review,” Ladick said. “Unfortunately – and I know this is a really tough pill to swallow – when people got their [notice of reassessment] letters in Sept., of course budgets weren’t set at that time, so there wasn’t necessarily an understanding of how this was going to affect their taxes. When people got that letter, that was their time to contest it; if people didn’t appeal before, they really missed that chance.”

Payment plans for those who can’t afford to pay their taxes all at once are offered via three installments at the treasurer’s office, he added.

Wiza said the increase is a temporary inconvenience, but one that will pay off in the long run.

“Going forward, we now have a sustainable plan that any project we do must generate enough taxes to pay for itself and the infrastructure it uses,” he said. “But the reval [sic] hadn’t been done in 14 years, and I can’t believe we didn’t have a capital plan in place before.”