Column: Being a fiduciary isn’t enough

By Jason Glisczynski

In the realm of private wealth management, the term “fiduciary” is often spotlighted as a mark of trust and integrity. A fiduciary is someone legally obligated to act in their client’s best interests, offering a foundational layer of confidence for individuals seeking guidance in managing their wealth. However, while the fiduciary standard is a critical component of trustworthy financial advice, it’s merely the starting point, not the finish line, in providing exceptional wealth management services.

Beyond the Fiduciary Standard: A Deeper Dive into Excellence

The fiduciary standard sets the stage for a relationship based on trust and duty. But in today’s sophisticated financial landscape, where complexities abound, being a fiduciary isn’t enough. Imagine you’re entrusting someone to build your dream home. Would you choose a builder who meets the minimum code requirements, or one who goes above and beyond, crafting a home that’s not only safe but also a masterpiece of design and efficiency? In wealth management, as in construction, the basics are just the beginning.

The Limitations of Focusing Solely on the Fiduciary Label

When a wealth management firm emphasizes its fiduciary status as its primary selling point, it may inadvertently suggest that its distinguishing features are limited. It’s akin to a restaurant highlighting that its food is edible – while true and important, it hardly captures the culinary experience diners seek. Investors deserve more than the minimum. They should look for advisors who not only meet the fiduciary standard but also bring a wealth of additional qualities to the table, such as deep expertise, innovative solutions, and a holistic approach to wealth management.

What More Should Investors Seek?

- Expertise Beyond the Basics: Advisors should possess a deep understanding of the financial landscape, including sophisticated investment strategies, tax optimization, estate planning, and risk management. This knowledge enables them to craft bespoke solutions that align with each client’s unique goals and circumstances.

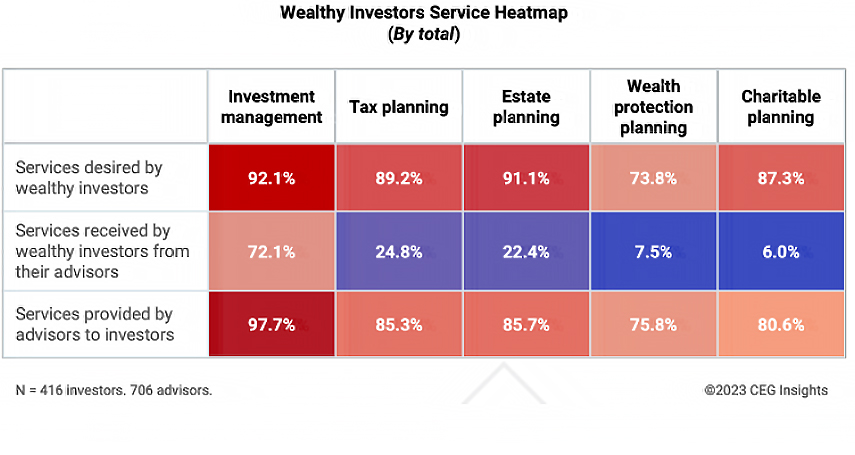

- A Holistic Approach: Exceptional advisors look at the big picture, integrating all aspects of a client’s financial life. This approach ensures that investment decisions are made within the context of the client’s overall financial plan, including retirement planning, legacy considerations, and philanthropic goals. While many advisors claim to have a holistic approach, studies suggest that they do not actually deliver on that promise, with nearly all advisors claiming they provide key services but clients not receiving them.

- Personalization and Attention: Clients deserve a wealth management experience tailored to their needs, with advisors who take the time to understand their aspirations, concerns, and lifestyle. A personalized approach ensures that strategies are not just effective but also resonate with the client’s values and priorities.

- Innovation and Adaptability: The financial world is ever-evolving, with new products, regulations, and opportunities emerging regularly. Advisors should be forward-thinking, embracing innovation to enhance their clients’ financial outcomes while also being adaptable to changing market conditions and personal circumstances.

- Commitment to Education: Empowering clients through education is paramount. Advisors should strive to demystify the complexities of financial planning, enabling clients to make informed decisions with confidence. This educational commitment fosters a more collaborative and transparent advisor-client relationship.

Elevating the Standard

While being a fiduciary is an essential quality of a trustworthy advisor, it is not the sole characteristic that defines exceptional wealth management. The best advisors distinguish themselves through their commitment to excellence, depth of knowledge, and personalized service, always aiming to exceed the foundational promise of acting in their clients’ best interests.

For individuals navigating the complexities of wealth management, selecting an advisor should involve a thorough evaluation of their expertise, approach, and values. Look for advisors who not only pledge to serve as fiduciaries but also demonstrate a comprehensive commitment to your financial well-being. This comprehensive approach ensures that your wealth is not just managed but nurtured, with strategies that reflect both your immediate needs and long-term aspirations.

In conclusion, while the fiduciary standard is a crucial aspect of financial advisory, it’s the baseline, not the pinnacle, of quality wealth management. The journey to financial security and prosperity demands more than adherence to a standard; it requires a partnership with advisors who offer depth, innovation, and a personalized touch, guiding you towards a future where your wealth achieves its fullest potential.

Jason Glisczynski is co-owner and principal advisor for Silvertree, LLC. He is a CERTIFIED FINANCIAL PLANNER™ Professional and a Certified Private Wealth Advisor Professional, and specializes in working with business owners, executives, and workers in manufacturing.

Investment Advisory Services offered through Brookstone Capital Management (BCM) LLC, a Registered Investment Advisor. Silvertree, LLC and BCM are separate companies. Visit www.silvertreeplan.com for more information.